Certainly, economic conditions play a crucial role in shaping the dynamics of the real estate market

- Let's delve into how GDP growth, inflation, and interest rates can impact the real estate sector:

- GDP Growth:

Positive Impact: A growing GDP often signifies a healthy economy. In such conditions, businesses are expanding, employment rates are higher, and people generally have more disposable income. This can lead to increased demand for both residential and commercial properties.

Negative Impact: Conversely, a slow GDP growth or economic downturn can result in reduced consumer confidence and spending. This can lead to a decrease in demand for real estate, affecting property values and potentially causing a slowdown in new developments.

- Inflation:

Positive Impact: Mild inflation can sometimes be positive for the real estate market. Property values may rise, providing a hedge against inflation. Real assets like real estate tend to hold value in times of inflation, making them attractive investments.

Negative Impact: However, high inflation can lead to increased construction costs and financing expenses. This might discourage new developments and impact the affordability of properties for potential buyers.

- Interest Rates:

Positive Impact: Lower interest rates typically make borrowing cheaper, encouraging people to take out mortgages. This can stimulate demand for real estate as it becomes more affordable for homebuyers and investors to finance property purchases.

Negative Impact: On the contrary, higher interest rates can lead to increased mortgage rates, making borrowing more expensive. This can dampen demand for real estate, especially in markets where affordability is a key concern.

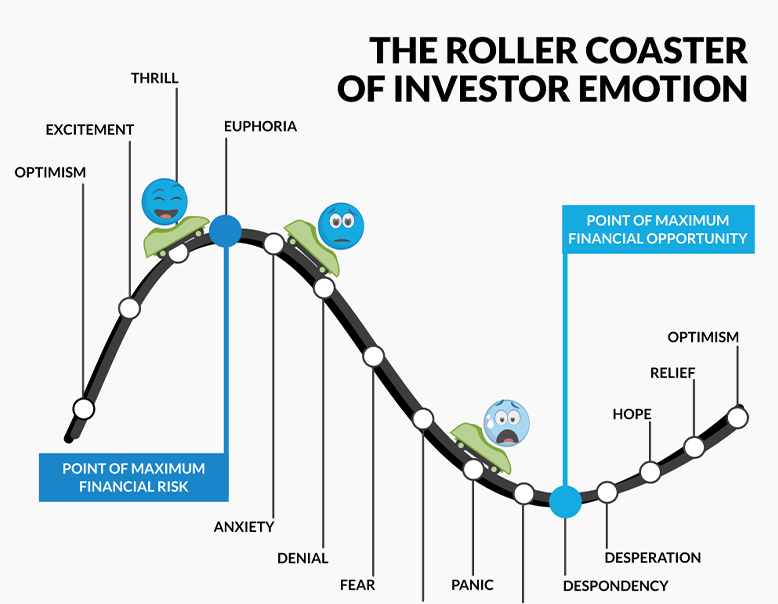

- Investor Sentiment:

Positive Impact: Favorable economic conditions can boost investor confidence. This confidence often translates into increased real estate investments, driving up property values.

Negative Impact: Economic uncertainties, especially related to GDP growth, inflation, or interest rate fluctuations, can make investors cautious. In such situations, there might be a slowdown in real estate transactions as investors adopt a wait-and-see approach.

- Government Policies:

Impact of Economic Policies: Government policies aimed at controlling inflation, promoting economic growth, or managing interest rates can significantly influence the real estate market. For example, incentives for affordable housing or tax breaks for real estate investments can stimulate the market.

- Conclusion:

Economic conditions are intricate, and their impact on the real estate market is multifaceted. Investors, developers, and homebuyers need to closely monitor these economic indicators to make informed decisions. Additionally, real estate professionals often adapt their strategies based on the prevailing economic conditions, navigating both challenges and opportunities presented by the economic landscape.