Certainly, investment strategies in the real estate market can vary based on the current economic conditions, market trends, and individual risk tolerance

- Here are some insights into potential investment strategies for the current real estate market:

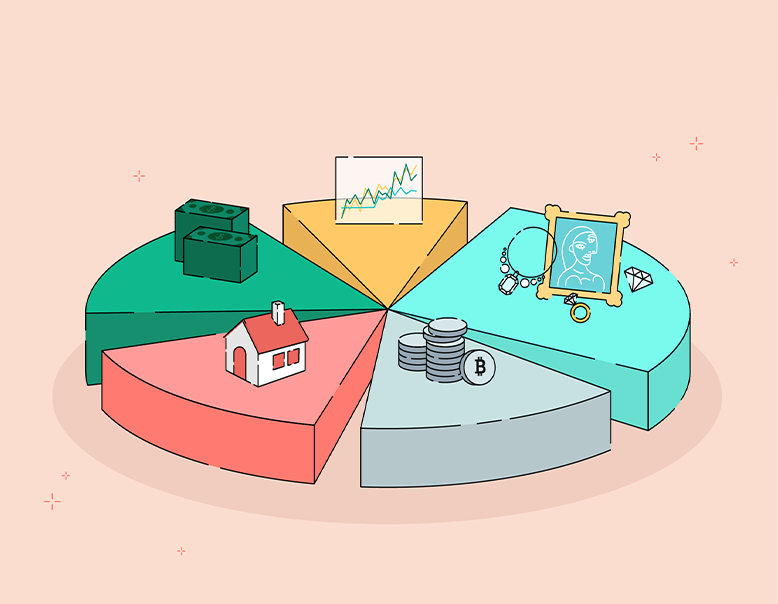

- Diversification:

Strategy: Diversifying your real estate portfolio across different types of properties can help mitigate risks. Consider a mix of residential, commercial, and potentially industrial properties to balance your investment portfolio.

Rationale: Diversification can provide stability, as different property types may respond differently to market fluctuations. For example, while residential properties might be influenced by housing demand, commercial properties might be more tied to business cycles.

- Location-Based Investments:

Strategy: Focus on properties in areas with high growth potential or undergoing infrastructure development. Urbanization trends and government initiatives can significantly impact property values in specific regions.

Rationale: Investing in locations with growth potential increases the likelihood of property appreciation. Areas with improving infrastructure, amenities, and accessibility often attract more tenants and buyers.

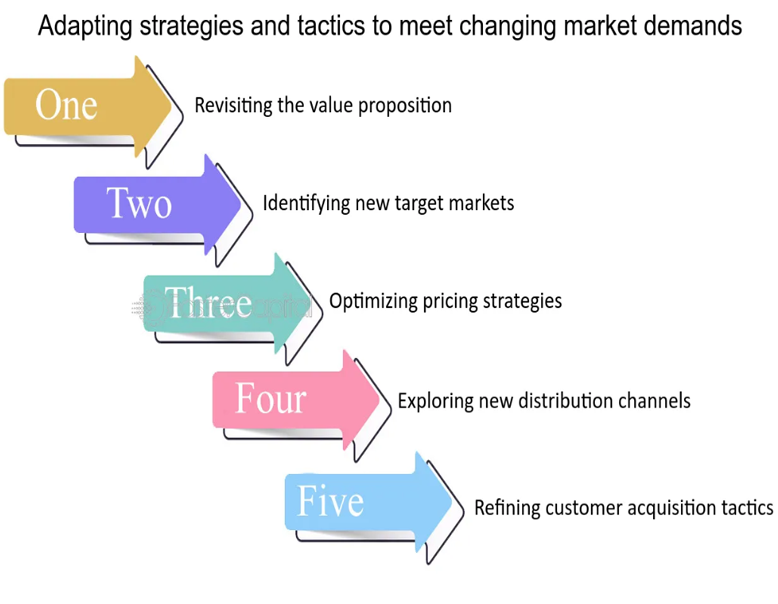

- Adaptive Strategies in a Changing Market:

Strategy: Stay adaptable to changing market conditions. Monitor economic indicators and be prepared to adjust your investment strategy based on shifts in interest rates, inflation, or GDP growth.

Rationale: Being flexible allows you to capitalize on emerging opportunities and protect your investments from potential downturns. Regularly reassessing your portfolio ensures that it aligns with the current market dynamics.

- Technology Integration:

Strategy: Embrace technology in property management, marketing, and investment analysis. Utilize data analytics, virtual tours, and online platforms to streamline processes and enhance decision-making.

Rationale: Technology can improve efficiency, reduce costs, and provide valuable insights. Adopting modern tools can give you a competitive edge in managing properties and identifying lucrative investment opportunities.

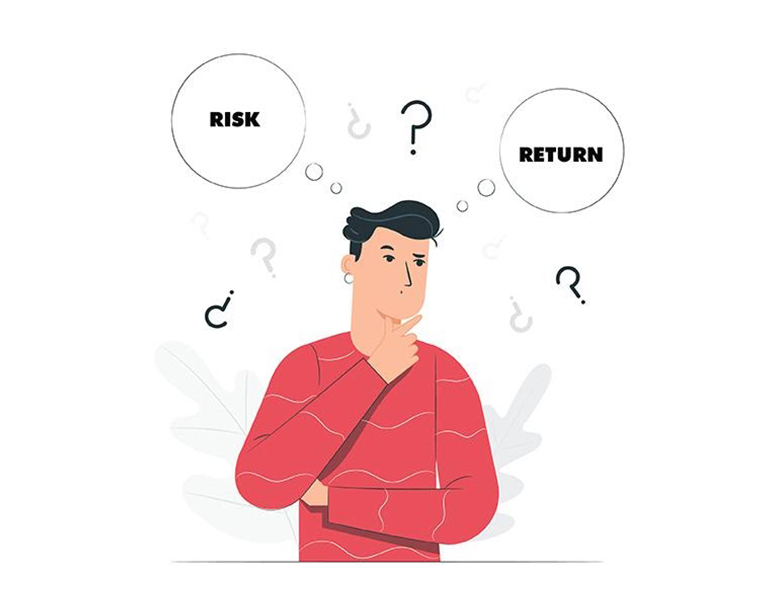

- Evaluating Risk and Return:

Strategy: Conduct thorough risk assessments before making investment decisions. Consider factors such as market volatility, economic conditions, and potential regulatory changes.

Rationale: Understanding and managing risk is crucial in real estate investing. While higher-risk investments may offer greater returns, they also come with increased uncertainty. Balance your portfolio to align with your risk tolerance and financial goals.

- Long-Term Sustainability:

Strategy: Consider sustainable and environmentally friendly properties. Green buildings and energy-efficient features are becoming increasingly attractive to tenants and buyers.

Rationale: Sustainable properties may not only align with ethical considerations but also position your investments favorably in a market where environmental consciousness is gaining prominence.

- Professional Guidance:

Strategy: Seek advice from real estate professionals, financial advisors, and market experts. Collaborate with professionals who can provide insights into market trends and potential investment opportunities.

Rationale: Professional guidance can help you make well-informed decisions and navigate complexities in the real estate market. Networking with experts also opens doors to valuable opportunities.

- Conclusion:

In the ever-changing landscape of real estate, a thoughtful and diversified approach is key. By staying informed, adapting to market dynamics, and considering both short-term and long-term factors, investors can position themselves for success in the current real estate market.